The head of the United Nations climate body, Simon Stiell, said on Wednesday a “quantum leap” in climate finance is needed for many countries to be able to submit strong new climate action plans next year.

“It’s hard for any government to invest in renewables or climate resilience when the treasury coffers are bare, debt servicing costs have overtaken health spending, new borrowing is impossible and the wolves of poverty are at the door,” he said in a major speech at the Chatham House think-tank in London.

Climate finance has traditionally consisted mainly of wealthy governments and multilateral development banks giving loans and grants to developing countries to help them reduce planet-heating emissions and adapt to climate change.

But Stiell’s speech focused heavily on other sources of finance, which would not burden taxpayers in rich nations but are unlikely to be agreed in time for next year’s round of climate plans under the Paris Agreement.

Stiell said governments must agree at the Cop29 UN climate summit this year “a new target for climate finance that meets developing country needs”. But, he added, “it’s not enough to agree a target. We need a new deal on climate finance between developed and developing countries.”

Billionaires and boats

That would include “new sources of international climate finance, as the G20, International Maritime Organization (IMO) and others are working on”, he noted.

The Brazilian government, as chair of the G20, wants the group’s 20 major economies to agree a minimum tax on billionaires, and has hinted that some of this levy could be spent on climate finance.

Spring Meetings can jump-start financial reform for food and climate

But this has not been agreed – and is likely to prove controversial. E3G analyst Sima Kammourieh said geopolitical splits over the wars in Ukraine and Gaza had held back G20 negotiations, as had the recent death of the Brazilian diplomat leading the discussions, Daniel Machado da Fonseca.

Governments at the IMO, meanwhile, have agreed to put a price on shipping emissions. But the IMO and government shipping negotiators have suggested they want most of this money to be used to clean up the shipping industry, not for broader climate finance such as the new UN loss and damage fund.

Spring meetings

Ahead of next week’s spring meetings of the World Bank and International Monetary Fund (IMF), Stiell reiterated his support for the Bridgetown Agenda, a set of international financial reforms that would shift more multilateral funding into tackling climate change.

“The Spring Meetings are not a dress rehearsal. Averting a climate-driven economic catastrophe is core business,” Stiell said. “It can’t slip between the cracks of different mandates.”

So far, the biggest reform agreed is a change to the World Bank’s debt-to-equity ratio of 1%. That will free up $4 billion a year – but while reformers are calling for more, opponents fear credit rating agencies will downgrade the bank, making it more expensive to borrow money.

European court rules climate inaction by states breaches human rights

The newest proposal in Stiell’s speech was his call for the IMF to make “more use” of an obscure pot of money called the Catastrophe Containment Relief Trust (CCRT).

The CCRT provides grants for debt relief to the world’s poorest countries when they are hit by disasters that meet a preset threshold of destruction.

But the IMF’s latest annual report described the trust as “critically underfunded” with “insufficient resources to provide significant relief” when another disaster strikes.

Old-fashioned finance?

French President Emmanuel Macron has been a vocal supporter of a new global pact on finance that would push more money into climate action into debt-strapped developing nations, hosting many world leaders at a summit in Paris last year to discuss the reforms.

But last month, France cut its aid budget by 12.5%. The UK has also reduced its aid spending in recent years, and shuffled the numbers to count more as climate finance – while a potential Donald Trump victory threatens the US’s already relatively low level of international climate funding.

Former French diplomat, Laurence Tubiana, who is now chair of the European Climate Foundation, told journalists yesterday that in Europe the “fiscal space is just non-existent”, adding “the agenda of the day is to cut public spending”.

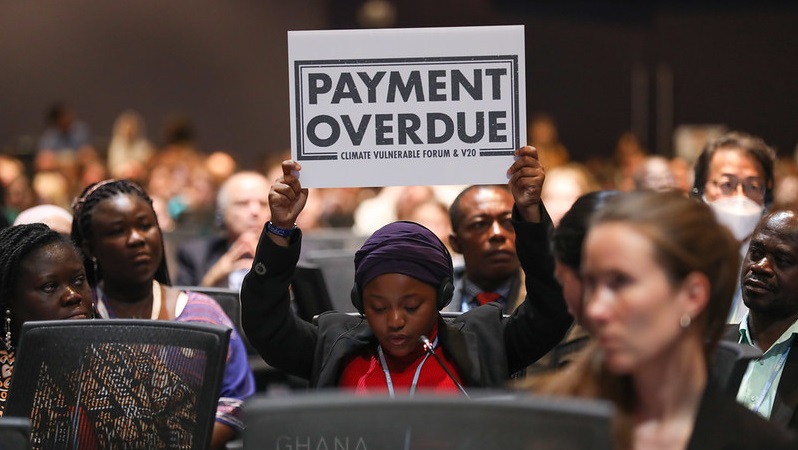

But Sara Jane Ahmed, finance adviser to the V20 group of climate-vulnerable countries, told Climate Home that rich nations can create more fiscal space by printing money, borrowing, taxing or cutting spending elsewhere.

In London, Stiell said a “quantum leap in climate finance is both essential and entirely achievable”, and argued that providing more is in the interests of powerful developed countries.

Without climate finance, he said, poorer nations would not submit bold new climate plans and then “all economies, the G7’s included, will soon be in serious and permanent strife”.